The Indian rupee recently hit an all-time low of ₹90.43 against the US dollar, sparking debates, panic, and confusion among the public. Many citizens immediately think a falling rupee is “bad news,” while an economic adviser claiming “it’s good for the economy” created even more questions.

But what is the real meaning behind this?

Why did the rupee fall?

Is it really good or bad for India?

Let’s break down everything in a simple, clear, and detailed way.

Read This Article : Why Apple Rejected India’s Sanchar Saathi App Order

What Does ‘Rupee at ₹90.43 per USD’ Actually Mean?

In simple words:

- It means India now needs ₹90.43 to buy 1 US dollar.

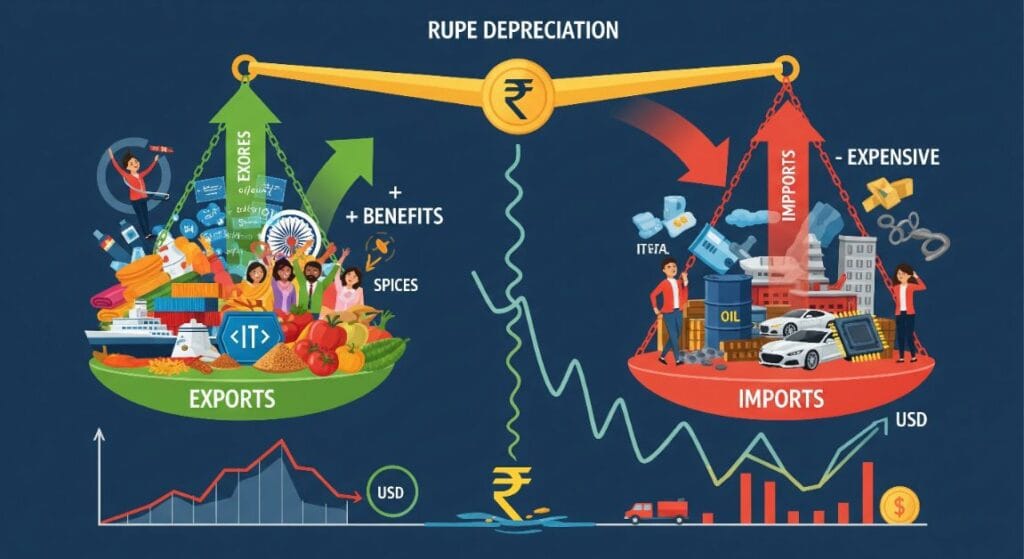

- When the rupee weakens, importing goods becomes expensive, while exporting goods becomes cheaper for other countries.

A weaker rupee affects every person from business owners to students studying abroad, from fuel buyers to smartphone users.

Why Did the Rupee Fall to This Record Level?

Many factors pushed the rupee into this zone. Here are the biggest reasons:

1. High Demand for US Dollars

When companies, investors, and the government buy more dollars for imports, the dollar’s value rises and the rupee falls.

- India imports oil, gold, electronics, machinery, etc.

- When global inflation rises, these costs also rise → more dollars needed.

2. Rising Crude Oil Prices

India imports 85% of its oil.

Oil is purchased in US dollars.

- When oil prices increase → India needs more dollars

- Higher dollar demand → Rupee falls

3. Foreign Investors Pulling Out Money

Foreign investors sell stocks and withdraw money from India during uncertainty.

- When they take money back to the US:

- They sell rupees

- They buy dollars

- Dollar rises → Rupee drops

4. Stronger US Dollar Globally

Whenever the US Federal Reserve increases interest rates:

- Dollar strengthens

- Other currencies weaken

- Rupee also falls along with global currencies

So, this is not just an India-only problem.

5. Trade Deficit Rising

If India’s imports are higher than exports:

- More dollars go out

- Rupee gets weaker

- Dollar becomes expensive

This is exactly what’s happening right now.

Is a Weak Rupee Really ‘Good for the Economy’?

This is the statement that confused everyone.

An adviser reportedly said a falling rupee can be good for the economy.

How can something that increases prices be good?

Yes, a Weak Rupee Helps in Some Areas

1. Boosts Indian Exports

Indian products become cheaper internationally.

- IT services

- Textiles

- Agriculture products

- Engineering goods

Exporters earn more rupees for every dollar they bring in.

2. Encourages Foreign Tourism

Foreign tourists find India cheaper → more tourism revenue.

3. Promotes Foreign Investment

A cheaper rupee makes Indian assets more attractive to foreign investors.

But It Also Has Big Negative Impacts

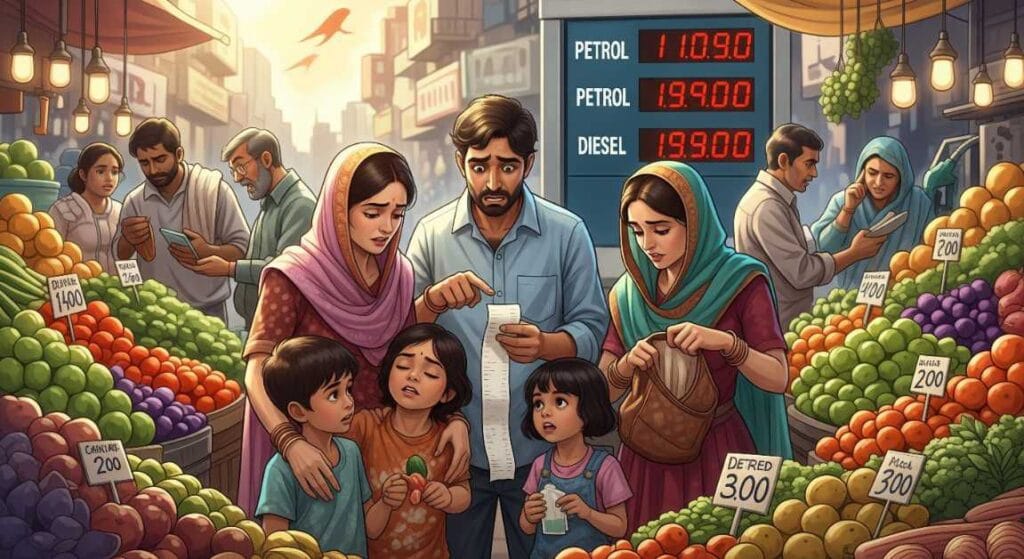

1. Petrol, Diesel, LPG Become Expensive

Because India imports oil in dollars → prices rise.

2. Electronic Goods Become Costlier

- Smartphones

- Laptops

- TVs

- Semiconductors

All become more expensive.

3. Students Studying Abroad Suffer

Parents need to pay more rupees for the same dollar-fee.

4. Inflation Increases

Every import becomes expensive → everything in the market becomes costlier.

So, Is It Good or Bad?

- Short term: Bad for middle class, fuel prices, inflation, and daily expenses.

- Long term: Can benefit exporters and businesses if managed properly.

The statement “good for the economy” is only partially true. It does NOT reflect the challenges common people face.

What Should India Do Now?

To stabilise the rupee, India must:

1. Reduce dependence on imports

Especially oil, electronics, and machinery.

2. Increase exports

More export = more dollars = stronger rupee.

3. Attract long-term foreign investment

Not short-term stock market money that leaves quickly.

4. Build stronger manufacturing in India

This reduces import bills.

5. Improve forex reserves

RBI intervention helps prevent extreme volatility.

Final Summary – What You Should Understand

- Rupee falling to ₹90.43 is a serious economic signal.

- It affects daily life, fuel prices, education costs, and business operations.

- Some sectors benefit, but the common citizen is impacted negatively.

- India needs strong policies to strengthen the rupee in the long run.

Conclusion :

In the end, bro, the rupee’s fall isn’t just a number on a chart it’s something that touches every household, every company, and the entire economy. Experts may say it “helps exports,” but the truth is simple: a stable rupee is always better than a weak rupee.

India must focus on self-reliance, lower imports, and strong economic planning. Only then can the rupee regain strength and protect the everyday citizen from rising costs.

Stability is the real strength, and India needs more of it in the coming months.

Read This Article : Fastest Growing Economies in 2026: India Leads Global Growth