PhonePe Introduces Biometric UPI Payments in India

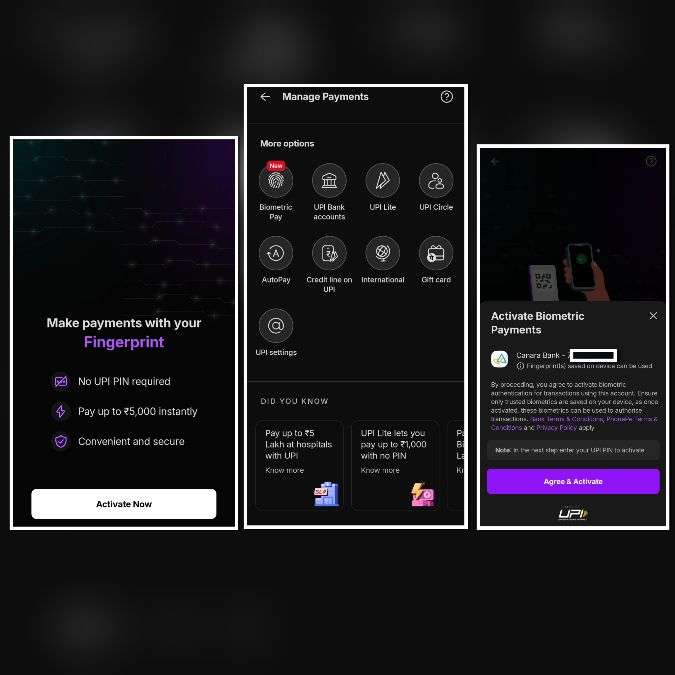

India’s digital payments ecosystem is evolving rapidly. In a major convenience upgrade, PhonePe has introduced biometric authentication for UPI payments. Users can now approve transactions using Fingerprint or Face ID instead of entering their UPI PIN for payments up to ₹5,000.

This move enhances speed, ease of use, and adds an extra layer of device-level security to everyday transactions.

How Does PhonePe Fingerprint Payment Work?

The feature replaces manual PIN entry with biometric verification for eligible transactions.

Step-by-Step Process:

- Open the PhonePe app

- Scan a QR code or enter UPI ID

- Enter the payment amount (within ₹5,000 limit)

- Choose biometric authentication

- Verify using Fingerprint or Face ID

- Payment is successfully processed ✅

The system still operates under the secure framework of the Unified Payments Interface, regulated by the National Payments Corporation of India (NPCI).

Image Credit: RAAD WORLD

What Is the Transaction Limit?

Currently, biometric authentication can be used for:

- UPI payments up to ₹5,000

- Small and daily merchant transactions

- QR code-based payments

For amounts above ₹5,000, users may still need to enter their UPI PIN depending on bank policies and NPCI regulations.

Important:Limits may vary slightly based on your bank and app version.

Why This Feature Matters

India is one of the world’s largest digital payment markets. With millions of daily transactions, faster authorization significantly improves user experience.

Key Benefits:

- Faster payments at shops

- No need to remember UPI PIN every time

- Reduced typing errors

- Helpful for elderly and new users

- Secure device-based authentication

This upgrade aligns with India’s push toward seamless and secure cashless transactions.

Is PhonePe Biometric Payment Safe?

Yes: but only if basic security practices are followed.

Biometric data:

- Is stored securely on your device

- Is not openly shared during transactions

- Works within encrypted UPI protocols

However, users must:

- Keep device screen lock enabled

- Avoid installing unknown apps

- Never share OTP or bank details

- Immediately block UPI if phone is lost

Biometric authentication adds convenience, but overall security still depends on user awareness.

Which Devices Support This Feature?

To use fingerprint or Face ID payments on PhonePe:

- Your smartphone must support fingerprint sensor or Face Unlock

- Device lock security must be enabled

- PhonePe app should be updated to latest version

- Your bank must support the feature

If biometric option does not appear, updating the app or checking bank compatibility may help.

Impact on India’s Digital Payment Ecosystem

The introduction of biometric UPI approval is another milestone in India’s fintech journey. As digital payments grow, user-friendly authentication methods will become more common.

With PhonePe leading innovation in this space, more payment apps may adopt similar biometric-based authorization features in the future.

Conclusion:

PhonePe’s biometric payment feature is a smart step toward faster and safer digital transactions. For payments up to ₹5,000, users can now skip entering UPI PIN and simply use Fingerprint or Face ID.

It is:

- Convenient

- Secure

- Time-saving

- Ideal for everyday transactions

However, users must stay alert against scams and maintain proper device security. India’s digital payment revolution continues mand biometric UPI payments are the next step forward.