With the beginning of January 1, 2026, many messages and posters circulating on social media claim that several “new rules” are being implemented across banking, UPI, electricity bills, LPG subsidy, and digital payments.

While some of these claims are based on real policy changes, others are misleading or exaggerated. Understanding the difference between verified updates and online rumours is essential to avoid panic and misinformation.

PAN–Aadhaar Linking Enforcement From January 1, 2026

The most important and fully verified change taking effect from January 1, 2026 is the strict enforcement of PAN–Aadhaar linking. Individuals who failed to link their PAN with Aadhaar by December 31, 2025 will find their PAN becoming inoperative.

An inoperative PAN cannot be used for filing income tax returns, opening bank accounts, investing in mutual funds, or conducting many high-value financial transactions. Although late linking is still possible by paying a prescribed penalty, services remain restricted until the PAN is reactivated. This step strengthens identity verification and reduces duplication in the tax system.

Read This Article Also: Indian Army Allows Instagram View Only Access For Personnel Rules Explanation About This

Income Tax Return Deadlines and Compliance Updates

From January 1, 2026, taxpayers will no longer be able to file belated or revised Income Tax Returns for the previous assessment year, as the final deadline ends on December 31. Only the updated return (ITR-U) mechanism remains available under specific conditions.

This makes timely tax filing more important than ever. In addition, financial institutions and credit bureaus will now update credit scores more frequently, allowing borrowers’ repayment behaviour to reflect faster in loan eligibility and interest rates.

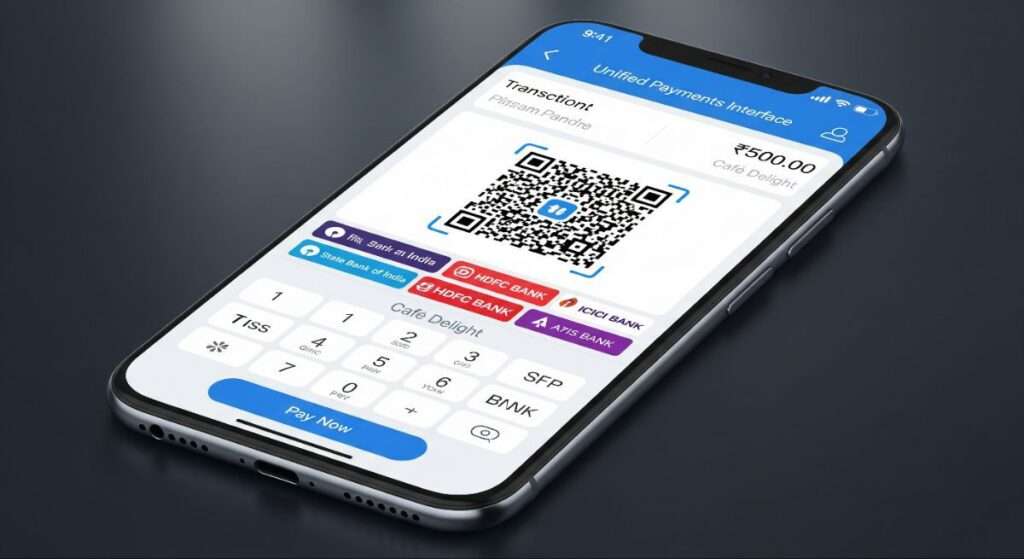

UPI and Digital Payment Rules: Facts vs Rumours

Social media posts claim that UPI transaction limits will increase from ₹1 lakh to ₹2 lakh for everyone from January 1, 2026. This is not fully accurate. As of now, the standard UPI limit of ₹1 lakh per day remains unchanged for most users.

However, higher limits may apply only for specific use cases such as education, healthcare, or capital market payments, subject to bank approval and NPCI guidelines. These adjustments are gradual and not a blanket increase for all users.

Another widely shared claim states that all digital payments above ₹5,000 will be tracked. In reality, digital payments are already monitored under existing financial and anti-money-laundering laws. There is no new law effective January 1, 2026 that introduces special tracking only above ₹5,000. This claim is misleading and often used to create fear.

Bank KYC Rules: No Mandatory Annual Freeze

Many viral posts suggest that bank KYC must be updated every 12 months, failing which accounts will be frozen. This is incorrect. Banks follow RBI’s risk-based KYC framework, meaning only certain accounts require periodic updates depending on customer risk profile.

There is no universal rule mandating yearly KYC for all customers from January 1, 2026. However, customers should still keep their KYC details updated to avoid service restrictions, especially in high-value or inactive accounts.

Electricity Smart Meters and Bill Reduction Claims

Another claim states that homes with smart meters will receive 15–20% lower electricity bills from January 2026. There is no national policy or notification guaranteeing such discounts.

Smart meters are being introduced for better billing accuracy, reduced power theft, and real-time monitoring not automatic bill reduction. Electricity tariffs remain under state electricity regulatory commissions.

LPG Subsidy and Verified Bank Accounts

LPG subsidy payments already require bank account verification and Aadhaar linkage under Direct Benefit Transfer (DBT). There is no new subsidy rule effective January 1, 2026 restricting benefits beyond existing requirements. Claims suggesting a sudden policy change are misleading.

Government Digital Platforms and Scheme Portals

The government continues to expand digital governance platforms to simplify access to welfare schemes. However, claims that a single unified portal for all government schemes will launch exactly on January 1, 2026 are not officially confirmed. Integration is ongoing, but no specific launch date has been announced.

Read This Article Also: Google Gmail Update: Users Can Change Gmail Address Without Losing Data

Conclusion: January 1, 2026 does bring important regulatory changes, especially regarding PAN–Aadhaar linking, income tax compliance, and financial transparency.

However, many viral claims circulating on social media such as mandatory annual KYC freezes, universal UPI limit hikes, smart-meter bill discounts, and ₹5,000 payment tracking are either exaggerated or completely false.

Citizens should rely only on official government notifications, RBI guidelines, NPCI updates, and reputed financial news sources before believing or sharing such information. Staying informed with verified facts helps avoid unnecessary fear and ensures smooth financial planning in the new year.