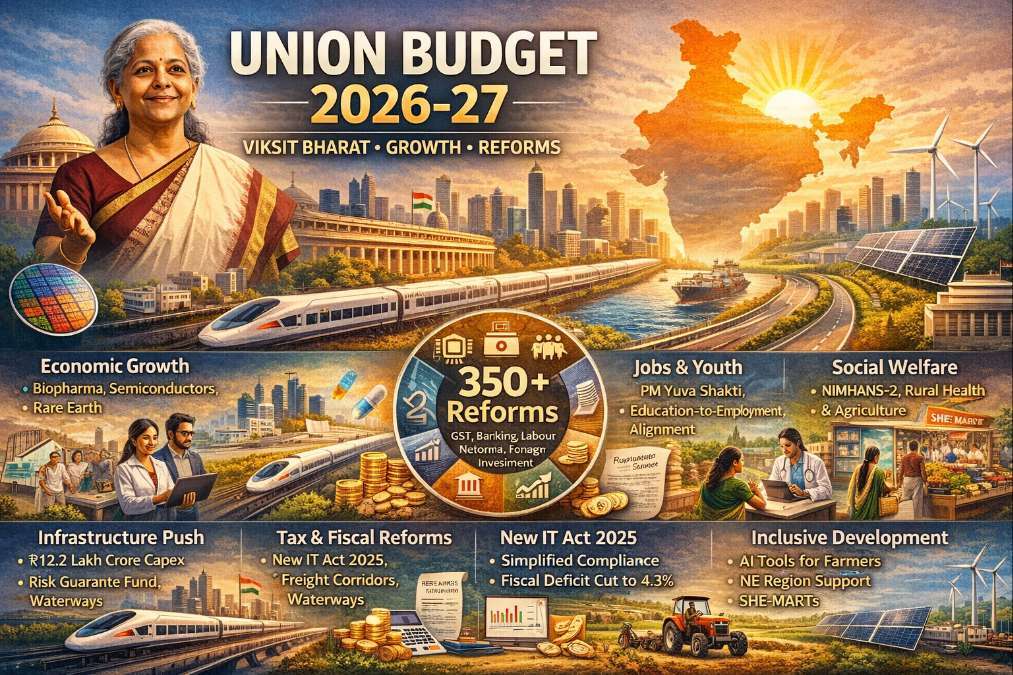

The Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman, marks a decisive step in India’s journey towards becoming a developed and globally competitive economy.

Anchored in stability, reform, and inclusion, this Budget reflects the government’s long-term vision of Viksit Bharat while responding to present-day economic and global challenges.

At a time when the world economy is facing supply chain disruptions, geopolitical uncertainty, and rapid technological change, India has chosen a balanced path one that prioritizes growth without compromising fiscal discipline or social responsibility.

READ THIS: Prime Ministers of India: Year-wise Tenure, Work, Schemes and GDP Growth (1947–2025)

A Clear Vision Built on Three Kartavya

The Budget is structured around three core responsibilities, described as kartavya. The first is to accelerate and sustain economic growth by improving productivity, competitiveness, and resilience.

The second is to fulfill the aspirations of citizens by investing in skills, employment, and capacity building. The third is to ensure inclusive development so that every region, community, and sector participates meaningfully in growth.

This approach provides clarity and continuity, ensuring that policy decisions are aligned with long-term national objectives rather than short-term populism.

Manufacturing and Industrial Expansion at the Core

Manufacturing remains a central pillar of Budget 2026–27. The government has announced targeted interventions to strengthen India’s position in strategic and frontier sectors.

Initiatives such as Biopharma SHAKTI aim to position India as a global hub for biologic medicines by supporting domestic production, research institutions, and clinical trial infrastructure.

The expansion of the India Semiconductor Mission 2.0 signals a strong intent to reduce dependence on imports and build a full-stack semiconductor ecosystem, including design, materials, and equipment manufacturing.

Increased allocation for electronics components manufacturing further strengthens India’s role in global value chains.

Traditional sectors are not left behind. The textile industry receives renewed attention through modernization schemes, skilling initiatives, and the development of mega textile parks, ensuring employment generation in labour-intensive industries.

MSMEs: From Survival to Global Champions

Micro, Small, and Medium Enterprises are recognized as engines of growth and employment. The Budget introduces a ₹10,000 crore SME Growth Fund to nurture high-potential enterprises into future champions.

Measures to strengthen liquidity through TReDS, credit guarantees, and faster settlement mechanisms will significantly ease cash-flow challenges.

Professional support through trained compliance facilitators, especially in Tier-II and Tier-III towns, is a notable step toward reducing the regulatory burden on small businesses. These reforms collectively aim to shift MSMEs from survival mode to sustainable expansion.

Infrastructure as a Growth Multiplier

Public capital expenditure has been increased to ₹12.2 lakh crore, reinforcing infrastructure as a key driver of economic momentum. Investments span transport, logistics, waterways, rail corridors, and urban infrastructure.

The introduction of an Infrastructure Risk Guarantee Fund is expected to boost private sector confidence by mitigating construction-phase risks. High-speed rail corridors connecting major economic centers further demonstrate the government’s focus on long-term productivity and regional integration.

Services, Skills, and Employment

Recognizing India’s demographic advantage, the Budget places renewed emphasis on the services sector. A high-powered Education-to-Employment committee will align education systems with industry needs, particularly in emerging technologies such as artificial intelligence.

Healthcare, tourism, animation, gaming, design, and hospitality receive targeted support to create large-scale employment opportunities. The expansion of allied health professional training and medical tourism hubs highlights India’s ambition to become a global services leader.

Agriculture, Rural Economy, and Inclusion

For farmers and rural communities, the Budget focuses on productivity, diversification, and value addition. Support for high-value crops such as coconut, cocoa, cashew, and sandalwood aims to enhance incomes while promoting export competitiveness.

The launch of Bharat-VISTAAR, an AI-powered advisory platform, represents a forward-looking approach to agriculture by integrating technology with traditional farming practices. Women-led enterprises are encouraged through SHE-Marts, enabling rural women to move from self-help groups to business ownership.

Fiscal Discipline with Growth

Despite ambitious spending plans, the government remains committed to fiscal consolidation. The fiscal deficit is estimated at 4.3 percent of GDP, and the debt-to-GDP ratio continues on a declining path. This balance between growth and discipline strengthens investor confidence and macroeconomic stability.

Tax Reforms for Ease of Living and Doing Business

The implementation of the new Income Tax Act from April 2026 simplifies compliance and reduces litigation. Relief measures for individuals, rationalized TCS rates, and streamlined return filing timelines enhance ease of living.

For businesses, changes to MAT, safe harbour rules for IT services, and incentives for foreign investment and data centres reinforce India’s attractiveness as a global business destination.

Conclusion:

A Budget with Long-Term Intent

Union Budget 2026–27 is not merely an annual financial statement; it is a strategic roadmap for India’s economic future. By combining structural reforms, targeted investments, and inclusive policies, the Budget lays a solid foundation for sustainable growth and shared prosperity.

While implementation will determine its ultimate success, the intent is clear India is preparing not just for the next financial year, but for the next generation.

Union Budget 2026–27: Frequently Asked Questions (FAQs)

1. What is the main objective of the Union Budget 2026–27?

The main objective of the Union Budget 2026–27 is to accelerate economic growth, create sustainable employment, strengthen manufacturing and services, and ensure inclusive development while maintaining fiscal discipline.

2. How much capital expenditure is allocated in Budget 2026–27?

The government has allocated ₹12.2 lakh crore towards capital expenditure in Budget 2026–27, focusing on infrastructure such as transport, logistics, railways, waterways, and urban development.

3. What are the major benefits for MSMEs in this budget?

MSMEs receive strong support through a ₹10,000 crore SME Growth Fund, mandatory use of TReDS for CPSE payments, credit guarantee support, and professional compliance assistance to reduce operational burden.

4. What changes are introduced under the new Income Tax Act?

The new Income Tax Act, effective from April 1, 2026, simplifies tax laws, reduces litigation, streamlines return filing, provides relief to individuals, and improves ease of compliance for businesses and taxpayers.

5. What is the fiscal deficit target for FY 2026–27?

The fiscal deficit for FY 2026–27 is estimated at 4.3 percent of GDP, reflecting the government’s commitment to fiscal consolidation without compromising growth.

6. How does this budget support job creation and youth?

The budget focuses on employment through manufacturing expansion, services sector growth, skill development, healthcare jobs, AVGC sector promotion, and alignment of education with employment needs.

7. What initiatives are announced for agriculture and farmers?

Key initiatives include support for high-value crops, livestock entrepreneurship, fisheries development, AI-based Bharat-VISTAAR advisory for farmers, and special schemes to improve farm income.

8. How does Budget 2026–27 promote infrastructure and connectivity?

The budget promotes infrastructure through freight corridors, high-speed rail projects, inland waterways, coastal shipping, urban transport, and an Infrastructure Risk Guarantee Fund to attract private investment.

9. What is Bharat-VISTAAR and why is it important?

Bharat-VISTAAR is an AI-based multilingual platform that integrates agricultural data and advisory systems to help farmers make informed decisions, reduce risks, and improve productivity.

10. Why is Budget 2026–27 considered important for India’s future?

Budget 2026–27 is important because it combines long-term reforms, strong public investment, job creation, technology adoption, and fiscal responsibility, laying a solid foundation for India’s journey towards Viksit Bharat.